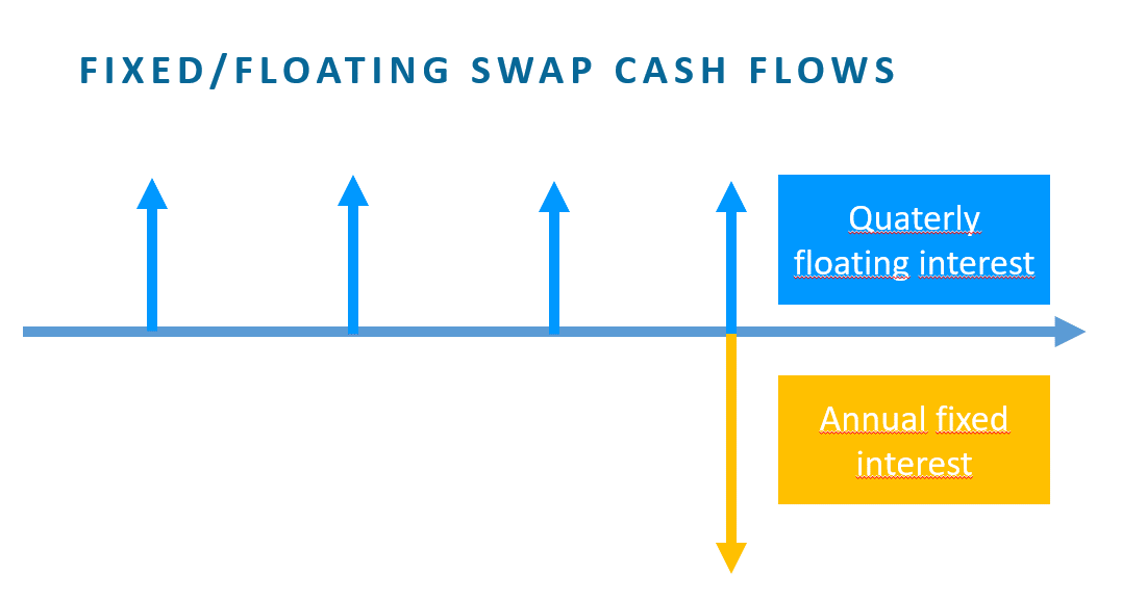

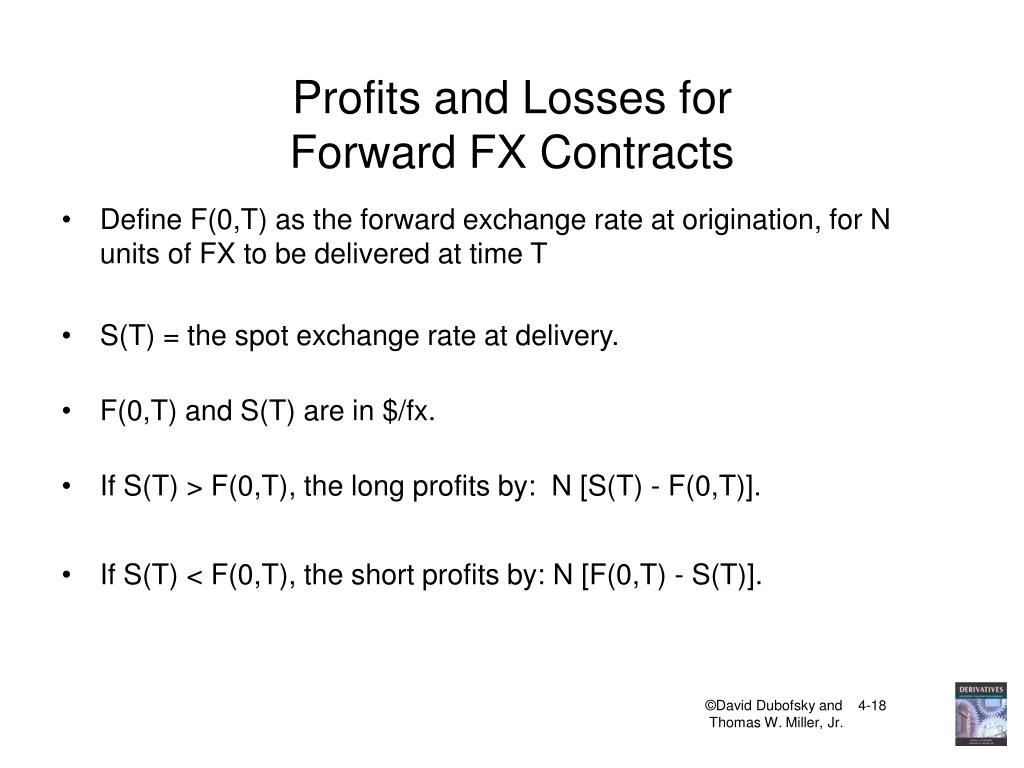

This kind of IRS is similar to the coupon swap. Both floating rates are referenced to the 1 month, 3, 6 or12 months Euribor, and are applied to a notional amount that is never exchanged.Ĭounterparty A pays 6 months Euribor semiannually and receives 3 months Euribor Quarterly for 5 years on a notional of €1,000,000 to counterparty B. This is an IRS in which one counterparty pays or receives a Floating rate with a reference tenor while receives or pays a floating rate with another reference tenor. The counterparty that pays the fixed rate is taken as the IRS buyer, while the IRS seller will be the counterparty that receives this fixed rate.Ĭounterparty A pays 1% annually and receives 6 months Euribor semiannually for 5 years on a notional of €1,000,000 to counterparty B. Both rates, the fixed and the floating, referenced to the 1 month, 3, 6 or12 months Euribor, are applied to a notional amount that is never exchanged. In this IRS, a counterparty will pay or receive an interest flow from a fixed rate, while will receive or pay another flow from a floating rate with a predefined frequency. The products which BME Clearing SWAPS will accept for clearing are: Coupon Swaps or Fixed - Floating IRS. One counterparty pays the flow while the other receives it. Interest Rate Swaps (IRS) and Forward Rate Agreements (FRA) are forward contracts in which two counterparties exchange periodically, and for a predefined period of time, flows derived from interest rates, but not the principal or notional amount.

0 kommentar(er)

0 kommentar(er)